Exploring the Future of Metal Cutting Technologies: Trends, Innovations, and Market Insights for 2024

The landscape of metal cutting technologies is rapidly evolving, propelled by advancements that cater to the growing demands of various industries. As we approach 2024, the global metal cutting market, valued at approximately $83 billion in 2023, is expected to witness a robust CAGR of around 7% over the next five years, according to a recent market report by Market Research Future.

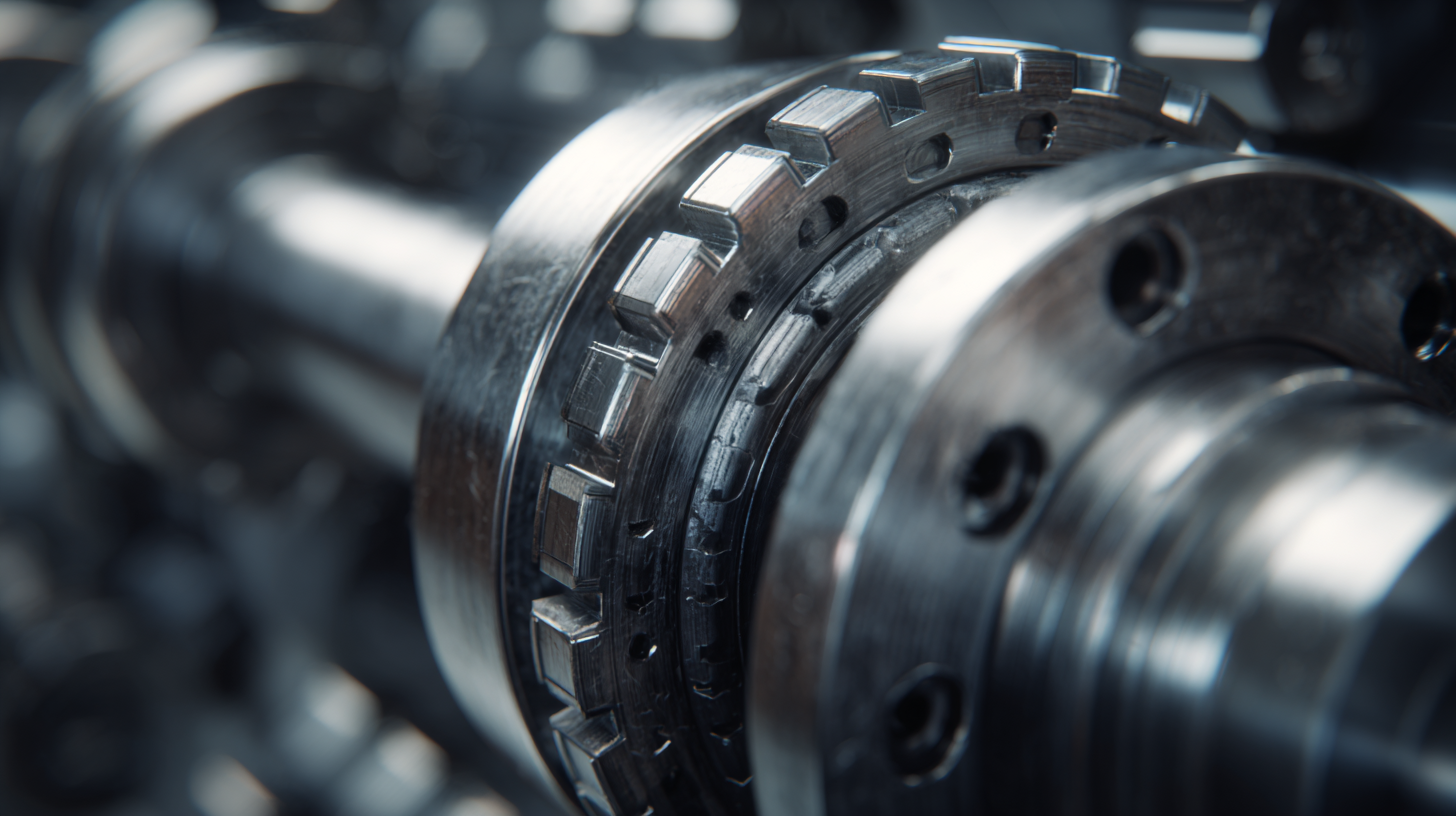

Innovations such as automated cutting systems, high-speed machining, and advanced tooling materials are at the forefront of this evolution, enabling manufacturers to enhance precision, efficiency, and sustainability in their processes. Furthermore, the increasing integration of smart technologies, including IoT and AI in metal cutting applications, is reshaping traditional practices, offering unprecedented levels of control and data analytics.

This article explores the future of metal cutting technologies, shedding light on emerging trends, innovative solutions, and valuable market insights that will define the industry's trajectory in the years to come.

Emerging Trends in Metal Cutting Technologies for Enhanced Precision and Efficiency

The landscape of metal cutting technologies is evolving rapidly, driven by emerging trends aimed at enhancing precision and efficiency across various industries. As the global metal cutting tools market transitions from a valuation of $80.87 billion in 2023 to an expected $113.04 billion by 2030, there is a noticeable push towards adopting advanced materials and methods. High-speed steel metal cutting tools, for instance, are projected to reach USD 13.3 billion by 2035, reflecting a CAGR of 3.9%. This growth highlights the industry's commitment to delivering quality outcomes while meeting stringent production demands.

Tips: Embrace automation and advanced manufacturing technologies to stay competitive. Implementing smart technologies can lead to significant productivity improvements, allowing manufacturers to optimize their processes effectively. Additionally, as the disposable drills market is expected to reach USD 2.0 billion by 2035, consider integrating disposable options into your operations to maintain quality while reducing costs.

Investing in innovations is essential; for example, the sheet metal fabrication services market is forecasted to grow from $22.32 billion in 2025 to approximately $33.31 billion by 2034. Such data emphasizes the importance of keeping pace with technological advancements, not only to improve efficiency but also to achieve enhanced precision in metal cutting applications. Adapting to these emerging trends will be critical for businesses aiming to thrive in an increasingly competitive landscape.

Innovative Tools and Machinery Shaping the Future of Metal Cutting

Innovations in metal cutting technologies are set to transform the industry landscape in 2024, as new tools and machinery continue to emerge. The integration of digital manufacturing technologies is enhancing productivity across a wide array of sectors. This shift not only streamlines manufacturing processes but also lowers costs, making advanced metal cutting more accessible for businesses. The rise of additive manufacturing particularly stands out, as it allows for the creation of complex parts with reduced waste, offering significant financial advantages to manufacturers.

The market is also witnessing an increased demand for automated tool grinding systems, projected to reach USD 3.1 billion by 2035. This growth reflects a trend towards automation, enabling companies to achieve higher precision and efficiency in their cutting operations. Furthermore, educational initiatives by industry leaders are crucial in fostering skills essential for future advancements. With ongoing innovations and a focus on automation, the metal cutting sector is poised for remarkable developments that will redefine operational standards in the years to come.

Trends in Metal Cutting Technologies for 2024

Sustainable Practices and Eco-Friendly Innovations in Metal Cutting

The metal cutting industry is undergoing significant transformation as sustainability takes center stage. In 2024, eco-friendly innovations in metal cutting technologies focus on reducing waste and energy consumption. Advanced machining techniques, such as laser and water jet cutting, have gained popularity for their precision and minimal material loss. Companies are increasingly investing in sustainable materials and recycling practices, ensuring that their production processes align with environmental standards.

Moreover, the integration of smart technology in metal cutting is fostering a shift towards more sustainable practices. Internet of Things (IoT) devices and artificial intelligence (AI) are being utilized to optimize machining processes, monitor energy usage, and predict equipment maintenance needs. This not only enhances efficiency but also reduces the carbon footprint associated with metal cutting operations. As the industry moves forward, embracing eco-friendly innovations will be essential in meeting both regulatory requirements and consumer demand for sustainable products.

Market Dynamics: Growth Opportunities and Challenges in the Metal Cutting Industry

The metal cutting industry is poised for significant growth in 2024, driven by emerging technologies and shifting market dynamics. According to a recent market analysis, the global hand tools market is projected to reach USD 43.96 billion by 2034, growing at a CAGR of 4.5%. This growth can be attributed to the increasing demand for precision tools and advancements in manufacturing processes, which are integral to metal cutting applications. Additionally, the global power tools market is forecasted to grow from USD 39.5 billion in 2024 to USD 45.5 billion by 2030, indicating a robust trend towards automation and efficiency in metalworking.

As these sectors expand, the metal cutting industry faces both opportunities and challenges. The surge in demand for industrial gases, expected to hit USD 158.3 billion by 2033, underscores the essential role of these gases in enhancing cutting processes in various applications, especially in healthcare. Furthermore, the emergence of innovative technologies, such as solid-state batteries projected to reach a $9 billion market potential by 2035, further emphasizes the evolving landscape of the industry. Companies must navigate these dynamic market conditions while leveraging technological advancements to remain competitive.

Exploring the Future of Metal Cutting Technologies: Trends, Innovations, and Market Insights for 2024

| Dimension | 2023 Value | 2024 Forecast | Growth Rate (%) |

|---|---|---|---|

| Global Market Size (Billion USD) | 57.5 | 63.2 | 10.0 |

| CNC Machine Tools Market Share (%) | 25 | 28 | 12.0 |

| Emerging Technologies Investment (Million USD) | 1,200 | 1,500 | 25.0 |

| Automation and Robotics Adoption Rate (%) | 18 | 23 | 27.8 |

| Metal Cutting Tool Sales (Million Units) | 15,000 | 16,500 | 10.0 |

Predictive Analytics and Automation: The Next Frontier in Metal Cutting Solutions

The landscape of metal cutting technologies is rapidly evolving, with predictive analytics and automation emerging as critical components for future advancements. According to a recent report by Markets and Markets, the global predictive analytics market is expected to grow from $10.95 billion in 2020 to $27.25 billion by 2026, reflecting a compound annual growth rate (CAGR) of 16.3%. This growth is fueled by the increasing need for precision and efficiency in manufacturing processes, allowing organizations to foresee and alleviate operational bottlenecks.

Automation technology in metal cutting is also gaining momentum. A report by Deloitte indicates that the implementation of automation in manufacturing can lead to a productivity increase of approximately 30%. By incorporating automated solutions and predictive analytics into metal cutting operations, manufacturers can optimize workflow and reduce material wastage significantly. This integration not only enhances performance but also allows for real-time monitoring and adjustment, leading to improved safety and quality outcomes. As companies invest in these technologies, the overall competitiveness in the metal cutting industry is poised to rise, setting the stage for a transformative shift in how metal fabrications are executed.